What's New for the 2024 Tax Season & Important Dates

- Laura Wilson

- Jan 29, 2025

- 4 min read

Updated: Feb 6, 2025

Happy New Year and Happy New Tax Season!

While not everyone is as excited for this time of year as me it's important that you stay up to date.

Most things stay the same year to year but this year there are credit extensions, tax increases, credit increases, changes to short term rentals, and more.

Here is what you need to know about all the new changes for the 2024 tax season along with the important dates you'll want to keep in mind.

What's New

Basic Personal Amount Increases

The basic personal amount credit for 2024 is $15,705 and it has increased to $16,129 for 2025. This is how much income you can make before you pay tax.

Donation Extension

A donation extension to February 28 has been proposed. This would allow you to claim donations from January 1 - February 28 2025 to be included on your 2024 tax return.

This is a proposed change and has not been voted into law, however, CRA is implementing it for the 2024 tax season as if it has passed. If the proposed change is denied once parliament reconvenes CRA will go back and adjust the affected tax returns to remove the 2025 donations.

Canada Pension Plan (CPP) Enhancement

2024 saw the implementation of a second additional CPP contribution of 4%. This increase is due on pensionable earnings above $68,500 for 2024 to a maximum additional contribution of $188. This amount is reported in box 16A (CPP) or box 17A (QPP) of your T4 slip. If you are self employed and your income was over $68,500 you'll need to pay the enhancement as well at a rate of $8% to a maximum of $376.

Changes to Québec Pension Plan (QPP) Payments

For 2024 and future years workers that are 65 or older may opt out of paying into QPP if they are receiving QPP or CPP payments.

Once you turn 73 you are no longer be required to pay QPP on any earnings in the year you turned 73 and for all future years.

Increase to Capital Gains Tax

Originally the capital gains inclusion rate was set to increase from 1/2 to 2/3 for capital gains realized after June 24, 2024. However, on January 31st the government announced that they will not be enforcing this increase until January 1st, 2026.

This new rate will apply to capital gains over $250,000. Capital gains of $250,000 or less will continue to have an inclusion rate of 1/2. This is a proposed change and has not been voted into law and a lot can happen between now and 2026.

The lifetime capital gains exemption will increase for dispositions happening after June 24, 2024. A new capital gains reduction add-back, deduction for qualifying business transfers, and additional security options deduction will be introduced.

Increase to Canada Carbon Rebate (CCR)

If you live in Alberta, Manitoba, New Brunswick, Nova Scotia, Newfoundland, Ontario or Saskatchewan you may be eligible for the CCR.

For the 2024 tax year CRA has increased the areas included in the rural supplement to now include census rural areas or small population centers (less than 30,000 individuals) in a census metropolitan area (CMA). The rural supplement gives you an additional rebate amount. To see if you're in a rural area go HERE.

This is a proposed change and has not been voted into law, however, CRA is implementing it for the 2024 tax season as if it has passed. If the proposed change is denied once parliament reconvenes CRA will go back and adjust the affected tax returns.

Increase to Home Buyers' Plan (HBP) Withdrawal Limit

The HPB maximum withdrawal limit has increased from $35,000 to 60,000 effective April 16, 2024.

CRA has also introduced a repayment delay if you made or will make your first withdrawal between January 1, 2022, - December 31, 2025. Instead of having repayments begin after the first two years you will now have five years before repayments begin.

Increase to Volunteer Firefighters' Amount (VFA) & Search and Rescue Volunteers' Amount (SRVA)

The VFA and SRVA credits increased from $3,000 to $6,000 for eligible volunteers. To qualify you must have performed a minimum of 200 hours of eligible volunteer work in 2024.

Changes to Short Term Rentals

Starting January 1 2024 you are not able to claim any expenses for a non-compliant short term rental.

CRA deems you non-compliant if:

You lack the permits and licenses from the local municipality or province where the property is located.

The short term rental is located in an area where there municipal or provincial government does not permit short term rentals to operate at.

This applies to individuals, corporations, and trusts.

Updates to the Rules for Digital Platforms

Digital platforms must now report sellers' information directly to CRA. Platform operators must provide you with an annual copy of the information that is collected and reported to CRA.

Digital platforms include sites that contract with sellers to make all or part of a platform available to them to connect with customers.

An example would be Amazon or Shopify.

Canada Child Benefit (CCB)

Beginning in 2025, eligibility for the CCB will be extended for six months after a child's death if the person claiming the CCB for that child is otherwise eligible. The person receiving the CCB must still notify the CRA of the child's death before the end of the month following the death. The extended period will also apply to the child disability benefit.

Extended Eligibility of the Mineral Exploration Tax Credit

Flow-through share agreements entered into before April 2025 for expenses that are incurred (or deemed to have been incurred) before 2026 are now included in the Mineral Exploration Tax Credit

Alternative minimum tax (AMT)

The AMT calculation has changed for 2024 and future years. You can find a complete list of changes HERE.

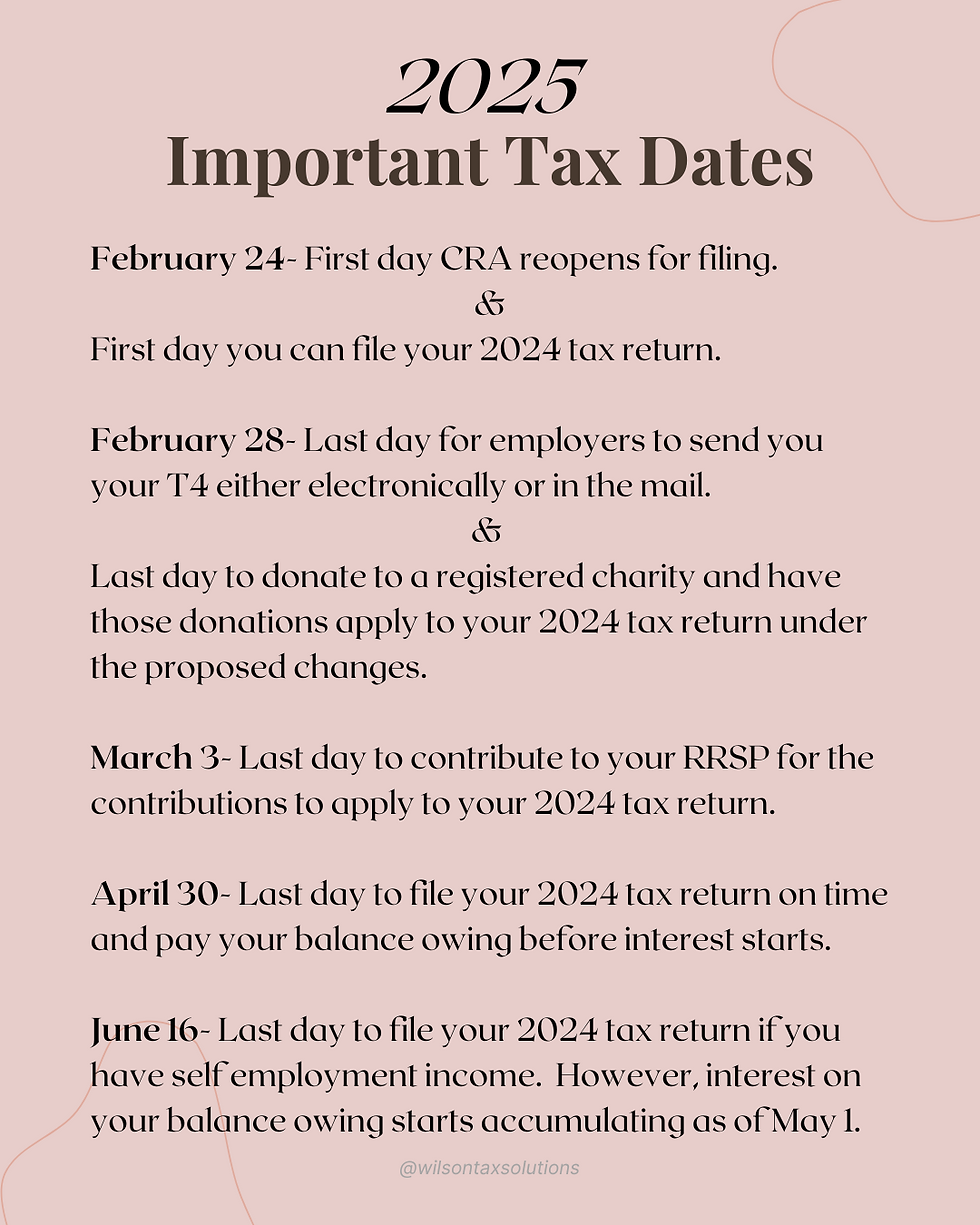

Important Dates

Want my help?

I am currently accepting new clients. I'd be happy to hop on a complimentary, no obligation Zoom call with you to discuss your tax situation in more detail, answer your questions, and get you a quote for my services. To book go to the booking calendar and select Personal Tax Filing.

Comments